Explore how the industry is responding to the challenge

Businesses across the globe are seeing this new normal as an uncertain phase. They are trying to adapt to the new reality and embracing smart technology investments for the future.

COVID-19 pandemic is reshaping industries in real-time and rapidly accelerating long-term underlying trends. The year 2020 is a turning point for the insurance industry. The pandemic is making insurance providers reimagine their business operations and customer experience. The unique and unparalleled nature of this crisis has brought with it challenging new circumstances – economic shutdowns, physical distancing, among others. Increased claims, additional risk, and solvency challenges are only a few examples of the current issues that the insurance providers are facing. They are accelerating investment in digitization and closing gaps in the business continuity models. The integration of third-party data to mitigate risk is increasing too.

The crisis highlights the need for insurers to seamlessly integrate reliable data sources, actionable insights, and responsive control measures to help navigate the uncertain landscape. By leveraging data and investing in digitization and analytics, insurers can navigate this challenging period and move ahead.

Key takeaways

- The key focus area for data modernization of insurance companies

- Role of cloud in accelerating the modernization journey

- Best practices and learning from data modernization

The session will cover

- How the insurance industry is accelerating digital transformation

- The crucial role of data in the transformation of the insurance industry.

- Need to build the right data foundation and its associated challenges

- The critical role of Cloud in the modernization journey

- Data modernization: key tenets, learnings, and best practices

The Host

The Panelist

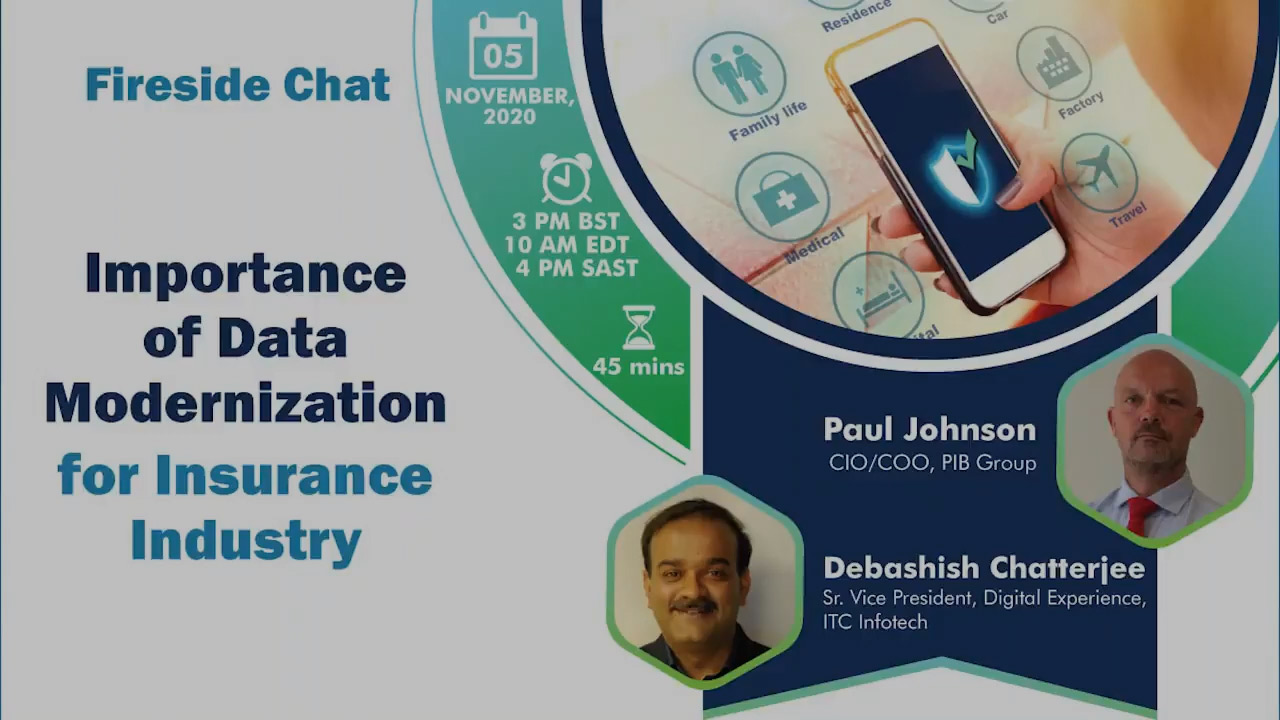

Paul Johnson

Chief Operating/Information Officer for PIB Group

Paul Johnson, Chief Operating/Information Officer for PIB Group. Paul joined PIB Group in October 2018. His career started at the Royal Navy where he was responsible for maintaining Electronic Warfare, Comms and Weapons. He then joined a technology company that supported a range of systems before moving to NatWest Bank, as well as other roles in financial services, consultancy for IBM and the airline industry.