Overcoming the challenges of conventional Planning and Performance Management through leading best practices

The Financial Planning and Analysis (FP&A) function in the CPG and Manufacturing sectors understands the need to improve the velocity, frequency and accuracy of Planning and Performance Management. This is especially true in a world where change can be forced by anything, from a pandemic to a policy change (to read about intelligent Planning and Performance Management for operational control and agility go here). Smart FP&A teams are going a step further. They are shoring up their capabilities by incorporating the latest industry-accepted best practices in their Planning and Performance Management systems. These best practices ensure they can confidently provide forecasts and guidance that align organizational resources to performance goals while maximizing revenue. The upside is significant. For example, improving forecasting accuracy to +/-5% or more can significantly increase shareholder value by more than 50% over planning horizon of 2 to 3 years.

The shortcomings of existing methodologies

- Traditional Planning and Performance Management processes are a minefield of challenges.

- They are manual, slow and prone to human mistakes.

- They also present the difficult task of integrating scattered and non-standard data from varied upstream source systems.

- The process is tedious but, more importantly, it does not allow teams to account for changes in business scenarios (new product introduction, new pricing strategy, non-availability of raw material/ talent, etc.). Without this capability, no business can respond quickly and accurately.

- Workflow limitations in existing systems are an additional problem. These result in situations where accountability of various functions remains obscure.

- Modern businesses also need to allow various users to access the data simultaneously and work in collaboration to drive consensus. These challenges and needs are becoming the prime drivers for organizations to re-visit and upgrade their Planning and Performance Management systems.

Depending on the type of industry – B2B, B2C Manufacturing or FMCG—an organization can change its planned numbers every quarter, if not more often, making it imperative to have sufficient dynamicity and flexibility in the planning and budgeting process.

Budgeting and planning data can be made most effective when it is distributed across business units. While this is necessary, it presents a security challenge. Organizations would like to make certain the data is made available on a need-to-know basis with adequate security and access controls.

Leading practices for tomorrow’s organizations

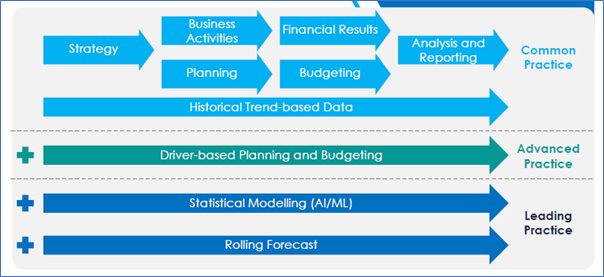

Figure 1 provides a comparative overview of traditional/ archaic/ poor practices versus common practice and leading practices including the involvement of reporting, forecasting and rolling forecasts. The figure shows the processes modern planning and management practices must possess.

Figure 1: Leading Practice

Figure 1: Leading Practice

Many organizations invest considerable energy in identifying and listing the best practices most suited to their strategic objectives. The list can be dauntingly long. However, there are a set of practices that cannot – and should not – be ignored. These are central to dependable and reliable Planning and Performance Management that meets future needs:

- Ensuring corporate objectives are aligned with the organization’s budgeting process: This calls for transparent two-way communicable between the strategic planning function and the budgeting procedure. The goal is to map high-level organizational objectives with resource allocation. To achieve this, an organization should:

- Formulate processes that allow top management to collaborate with teams directly involved in the day-to-day functioning of the organization.

- Maintain a transparent and fluid flow of information across functions that participate in the budgeting and planning exercise—maintain a uniform level of understanding of strategic goals and explicitly state the roles each team plays to fulfil the goals.

- Drive clarity of vision so that departments produce their budgets inclusively rather than in seclusion, leading to better coordination of tactics and support activities amongst the functions.

- Designing comprehensive budgeting procedures to ascertain desired results: A typical planning and budgeting exercise recognizes the factors vital to a company’s success and the ways in which those factors relate to the KPIs which measure business growth. Another way to look at them is as Business Drivers which can be further categorized as Revenue Drivers and Cost Drivers. Budgeting processes must be designed to ascertain these by:

- Acting as a “sanity check” for the strategic plan, allowing only those procedures that turn plans into action.

- Associating planned objectives with optimum resource allocation for process management. For example, if a target objective for a manufacturing organization is “less than1% defective products”, the drivers for achieving the same will have to be “ensuring stringent and state-of-the-art product quality tests” and “keeping track of products sold vs. products returned or repaired”.

- Preventing functions from becoming over burdened with procedures and unnecessary levels of granularity. These end up making processes cumbersome without adding significant value. For example, budgeting at a project/module level is always better than budgeting at an individual line-item level.

- Maintaining proper documentation with guidelines, accurate timelines, clear objectives, and appropriate resource assignment to enhanced efficiency and increased accountability.

- Creating driver-based planning and rolling forecasts. The absence of rolling forecasting results in hiding the true picture leading to incorrect conclusions and decisions.

- Integrating rolling forecasting with a driver-based approach by leveraging both financial and operational data to achieve optimal effectiveness of budgeting practice.

- Activity-based budgeting approach: Activity-based budgeting is derived from activity-based costing. Activity-based budgeting establishes the relationship between resources and activities and maps it to cost objects or services. This provides the actual cost for each object or service and aids in eliminating hidden costs, preparing accurate budgets and assigning accountability to managers who have control over the resources. Activity-based budgeting leads to:

- Optimal needs-based assignment of resources.

- Clarity on most and least expensive products/ services, providing visibility into real product/ service profitability.

- Assessment of the existing efficiency of the organization, leading to decisions around capex investments or disposal.

- Determination of appropriate cost baseline—which can be influenced through process or technology that reduces the effort for the activity.

These best practices, especially those with a 3-month rolling forecast, provide a dependable way for CPG and Manufacturing organizations to navigate volatile business environments. They are necessary to lay the foundation for realistic and real-time Planning and Performance Management.

- Learn about intelligent Planning and Performance Management to gain total operational control and agility

- Learn about the sequence of activities and authorizations of a typical planning and budgeting process of a CPG or Manufacturing company following industry leading practices

Leverage intelligence to improve your Planning and Performance Management — download our whitepaper now!

Author:

Rajarshi Gupta

General Manager – Data

ITC Infotech

Recent Posts

Enterprise Architecture Reimagined: Exploring its Facets in the AI Epoch

Enterprise Architecture Reimagined: Exploring its Facets in the AI Epoch Why organizations using DevOps tools are getting ahead of the rest

Why organizations using DevOps tools are getting ahead of the rest Generative AI: Creating the lightning rods for success (around a 3A Axis)

Generative AI: Creating the lightning rods for success (around a 3A Axis) Generative AI, a new catalyst for D2C expansion

Generative AI, a new catalyst for D2C expansion How to Maximize Business Productivity with Gen AI?

How to Maximize Business Productivity with Gen AI?