Banking in the time of a Pandemic – What should the banks do during and after COVID-19?

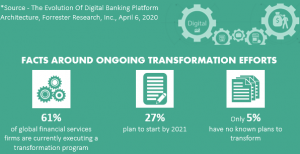

We all know that Banking constitutes an essential service and was one of the first sectors to embrace Digital Transformation, which is considered the panacea for COVID-19.  When COVID-19 struck, there was an initial view that banking will not be significantly impacted by COVID-19 as compared to other sectors such as Travel and Hospitality. However, we know that the digital enablement of banks is at various stages and maturity levels. According to Forrester*, banks are just going through the motions of transformation; only 14% of global financial services firms believe that they have the right technology infrastructure and applications in place to deliver great and differentiating CX. This tells us that all banks were not ready to face the challenges brought to the surface by the pandemic-induced lockdowns.

When COVID-19 struck, there was an initial view that banking will not be significantly impacted by COVID-19 as compared to other sectors such as Travel and Hospitality. However, we know that the digital enablement of banks is at various stages and maturity levels. According to Forrester*, banks are just going through the motions of transformation; only 14% of global financial services firms believe that they have the right technology infrastructure and applications in place to deliver great and differentiating CX. This tells us that all banks were not ready to face the challenges brought to the surface by the pandemic-induced lockdowns.

Given the dire situation, many areas will emerge where less prepared banks will be impacted – particularly those with limited digital or self-servicing capability. The dimensions of this impact will be felt across both customers as well as employees. There have been several reports of Tier 1 banks – including Lloyds in the UK, Bank of America, Mashreq, and Westpac to name a few – who have reported significant fall in profits, primarily on account of bad loan provisioning.

While for the normal end customer, there may be no impact on availing banking services, across all standard transactions like payments, direct debits, and funds transfer, etc., underlying issues faced by banks, building societies and financial institutions will continue to remain. I was a panelist in an ITC Infotech Global Webinar where the banking fraternity from almost all parts of the world participated, and we discussed this topic in detail and generated revealing insights.

Not surprisingly, according to our audience the most impacted Banking areas were back-office operations, followed by call centers, and finally, customer self-service channels.  It appears that almost all focus of Digital Transformation done by banks focused on the customers and less on internal-facing touchpoints. Given the remote working of staff and the huge call volumes, back office-operations and call centers may be unable to function as they should.

It appears that almost all focus of Digital Transformation done by banks focused on the customers and less on internal-facing touchpoints. Given the remote working of staff and the huge call volumes, back office-operations and call centers may be unable to function as they should.

So, while Banks were arguably better prepared for COVID-19 than other sectors, they are still impacted due to the unprecedented nature of this situation. There are staggering reports of huge impact on customers and employees – customers unable to avail critical services due to closed branches and call centers having horrendous wait times. Moreover, due to staff working remotely or off sick or in isolation, they are unable to perform all functions effectively. This has and will continue to cause challenges for banks and financial institutions across all lines of their business. They not only need to continue business as usual but also work with the respective branches of the governments to make sure that the neediest are not left out – especially across small businesses and the retail spectrum. Among other things, they need to ensure that the monetary benefits, loans, and grants reach those who require them in a timely fashion.

Now, let’s take a look at the areas majorly impacted due to COVID-19.

Customer Impact

- Branch operations – Due to closures, functions typically done in branches will have to be enabled on self-service channels. Small-medium banks/regional banks/building societies will be most impacted. Lack of self-service capability will mean that the vulnerable and needy segments of the population, who are either sick or not digital savvy, will not be able to avail banking services. Even if there is self-service capability, it will now have to take a larger load of the transactions, and it will have to be reliant.

- Customer Key Transactions – Lack of automation for all functions means that even some of the critical customer transactions, e.g., high-value/international funds transfer, mortgage transactions, loan applications, etc. might get stuck due to unavailability of self-service capability in these areas as well as unavailability of bank staff. Banks need to look at creating additional self-service capability rapidly without impacting their core systems. These capabilities may need to be launched in days or weeks.

- Impact on the most vulnerable – Vulnerable and old customers, who are in self-isolation or customers who are not digitally savvy or from the poorest sectors of the society are most impacted. While the majority of customers, at least in advanced markets, can continue to avail all the critical services they might need digitally, the vulnerable segments need more focus. Banks need to look at Digital workers/BOTs who can engage with the segment and enable BOT-assisted self-servicing, which can be delivered through an app, portal, push notifications, or even text messages.

Colleague Impact

-

- Contact Centre/Customer Help Desks – Bank’s help desks are likely to be inundated with an unprecedented number of customer calls on account of Branch closures and/or limited self-service capabilities, which will result in more requests/queries directed to the contact center. Staff going on sick leave or lack of remote working options for contact center staff means that tickets will pile up. Lack of remote access to the bank and automation options on top of core systems will result in even simple cases not being closed. Banks need to look at investing in Digital/BOT workers who can not only stand in and augment bandwidth to the bank’s helpdesk teams but can also provide 24×7 real-time solutions to its customers.

-

- Back-office functions – Banks running legacy may not have enabled home working for all functions, particularly back-office workflows. This means that if key workers are off sick, the cases and transactions will get piled up and cause bottlenecks in the overall operations. Banks need to look at automating bank-office functionals to enable straight-through processing and rule-based cognitive workflows.

- IT Support Functions – Due to the unavailability of bandwidth and with people becoming sick or unable to work, planned changes as well as the bank functions, get impacted. This will be compounded by the fact that more employees are working remotely and from different locations. The new working model is bound to lead to more support requests and incidents, which will have to be handled in innovative ways. Again, similar to the Customer Helpdesk, banks should seriously look to create a state of the art BOT enabled Service Desk, which will be more resilient and efficient.

Revenue & Profitability

- Provisioning against Bad loans – Given the pandemic situation, there is a strong possibility for SME and small corporates becoming delinquent, leading to interest income write-offs. Banks will need to make significant provisions for bad loans, which will impact profits. Lloyds (in the UK) have announced that their pre-tax profits have fallen by 95% due to bad loan provisioning, and a number of Global banks have followed suit with significant profit fall reports.

- Reduction in Fee-based income – Interest/fee-based incomes will reduce due to interest rate cuts and lower transaction volumes. Banks will potentially decide not to pass the benefits of interest rate cuts to its customers as the economic stimuli like mortgage holidays will need to be funded, and just the Govt. grants will not be enough. Banks will need AI/ML-led cross-sell and up-sell capability for new ‘paid’ products, which will offer additional value to customers.

- Identify & Help Vulnerable to avoid Bad loans – Banks will also need to proactively monitor and help/assist these customers, which will ensure there are limited bad books. Some of these customers may not have understood or availed the Govt. grants and loans due to a variety of reasons, and a proactive reach-out is essential. Instead of using traditional mechanisms, banks should launch special COVID apps and solutions to handle this situation.

Regulatory and Compliance Related

- Adhere to Regulatory/Central Bank directives – There will be a need to launch new products and modify existing products. As central banks inject stimulus to the economy in the forms of benefits, interest holidays, and new loan products, banks will need to stand up new functionality quickly to adhere to the central bank timelines. Banks will need to launch solutions quickly to help their customers and/or use this opportunity to widen their customer base.

- Increased Risk of Fraud and Money Laundering – In this time of crisis, there is an increased risk of customer fraud and cross-border money laundering, as well as illegal funds transfer. Lack of heightened enterprise fraud management will lead to regulatory fines and reputational risks as well. Again, analytics and AI/ML-based cognitive solutions will be the key to helping banks identify potential cases and prevent loss and customer impact.

Technology Impact

-

- Scalability & Resilience of IT Systems – One aspect that the COVID-19 pandemic has brought to the fore is the resilience and scalability of the banks’ technology platforms. Some of the platforms, even at Tier 1 banks, are decades old and are tuned only to operate under normal circumstances. Banks are now seeing unprecedented transaction levels related to COVID-19 stimulus packages announced by central banks. Banks who used to process around hundreds of new loan applications a day are now getting more than a hundred thousand each day! Their systems are unable to cope, and banks need to look at quickly fixing the solutions while making new ones for the COVID-19 context without impacting their core systems. One mechanism is to divert the COVID transactions away from the core systems into a new application that is resilient and can scale and take the brunt, passing it on the core in a much more controlled manner.

-

- Strengthen Remote Working – Traditionally, remote working enablement was done for a limited set of functions and applications.

Banks have to re-look at this setup and extend this to all critical business applications so that the operational risks and customer impact are minimized. When we asked our Global audience for their views, the majority of them responded that the remote working of staff is going to be the new normal. In connection to this, Barclays CEO Jes Stanley recently said, “The notion of putting 7000 people in a building may be a thing of the past.”

Banks have to re-look at this setup and extend this to all critical business applications so that the operational risks and customer impact are minimized. When we asked our Global audience for their views, the majority of them responded that the remote working of staff is going to be the new normal. In connection to this, Barclays CEO Jes Stanley recently said, “The notion of putting 7000 people in a building may be a thing of the past.”

- Strengthen Remote Working – Traditionally, remote working enablement was done for a limited set of functions and applications.

Conclusion

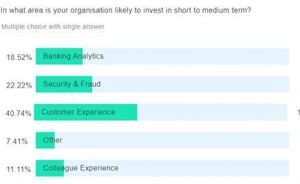

This pandemic has brought several issues to the forefront. While no new non-discretionary spend related initiatives or interventions are likely to start, banks will at-least spend the time planning and conceptualizing their transformation initiatives. Bringing out some more results from our Global Webinar, we asked our audience what areas they are likely to focus on and invest in the medium term, and not surprisingly, Customer Experience continues to be the main focus areas with Colleague Experience also featuring as a key area as the focus on back-office Digitization keeps gaining more and more momentum.

While no new non-discretionary spend related initiatives or interventions are likely to start, banks will at-least spend the time planning and conceptualizing their transformation initiatives. Bringing out some more results from our Global Webinar, we asked our audience what areas they are likely to focus on and invest in the medium term, and not surprisingly, Customer Experience continues to be the main focus areas with Colleague Experience also featuring as a key area as the focus on back-office Digitization keeps gaining more and more momentum.

The top 5 initiatives that I think Banks and Financial Institutions should focus on are:

- Rapid enablement of their digital customer and colleague experience solutions – Self-service capability across all their business functions, not just limited to customer-facing functions.

- Digital worker/BOT based helpdesks – Both for Customer help desks and Internal IT help desks, which augment the capability of the human workforce/agents.

- Focus on scalability and resilience of their IT Platforms (Core IT) – Review the platform and start making plans and business cases for their transformation.

- Strengthen cyber-security and enterprise fraud management solutions – When more functions are brought, online there is a big risk of Cyber/Ransomware crimes. Lack of strong fraud safeguards makes any online/self-service capability they offer at risk of being exploited by criminal elements.

- Revenue Risk Mitigation – In the event of an economic downturn, there is a possibility of customers becoming delinquent as well as fee income reducing. Banks need to find ways to remain competitive and profitable. Banks will have to invest in solutions which will enable cross-sell/up-sell and also identify potential customer risks.

ITC Infotech has launched several Banking-focused solutions to manage the COVID-19 situation and provide better preparation for the post-COVID world. Our solutions cover every single aspect and dimension mentioned above and offer point capability in all these areas. Please contact us to know about our industry-leading offerings.

The Global Webinar I have referred to in this paper is now available as an On-Demand Webinar. Please do take time out to participate and provide your feedback, which will help us to further calibrate and finetune our COVID-19 response. You can access the Webinar here.

Author:

Ranjith Ranadheeran

General Manager – BFSI