Rapid Acceleration of Digital Transformation

The Financial Services industry is witnessing a rapid acceleration of digitization and the adoption of new and emerging technologies to bring in operational efficiencies, increase speed-to-market and delivery of superior experiences to customers. Concepts of Embedded Banking or Contextual Banking that leverage Open Banking enablement and require deep understanding of customers by analyzing data are gaining traction.

2021 is going to see a renewed focus on automation and lead towards the emergence of connected banking via bank’s deep collaboration with customers, fintechs and other partners. Banking operations are going to become much more agile, with an increasing need to access data anytime, anywhere. According to Gartner, the pace of automation is accelerating, with more organizations creating fully automated value chains. Banks continue to move out of siloed business information warehouses and instead create a secure data lake in the cloud. Additional emerging trends include:

⦁ Applications are becoming cloud first

⦁ Information security remains paramount

⦁ AI/ML becoming mainstream and core to solving problems

⦁ Co-creation of products and services with customers underway

⦁ Open API and microservices architecture taking center stage

⦁ Financial offerings are becoming embedded within customers/partners business models

Leveraging Digital Traffic

Banks are increasingly embracing the digital space, and sales that banks make digitally have become the new benchmark for success. Most financial institutions wish to support a large part of their customer’s journey digitally. Think about the last time a customer visited a physical branch and the same will invariably not be a happy path especially in the current environment. It may be limited to a certain small segment of the population and/ or may provide insights for internal process change.

Most banks promise their customers a hyper-personalized digital experience but often fall short. No matter how much they have invested in building a robust mechanism that effectively displays their digital capability, they are unable to optimize for or comprehensively support their customers’ needs. As a result, their digital sales revenues and NPS fall short of reaching its full potential

According to the Boston Consulting Group, the scope for engagement with the customer is 50 times higher digitally than through physical visits, so banks must take advantage of this. Customers’ expectations are changing, and banks need to keep up. They need to leverage customer behavior in real-time and be an active part in their customer’s journey directly or via partners.

But how can banks reach the full potential of digital engagements?

McKinsey has the answer. Adopting tailored customer conversations and providing customers with personalized bank offers across multiple channels will lead to filling up this lacuna in the digital banking and personalized marketing setup.

Banks would need to deliver a platform that gives customers every possible push to buy their products & services through accessibility, customization, and a smooth digital interface, one that overall provides a memorable experience. The importance of optimizing digital sales is presented via some statistics that Forrester presented:

- 81% of banks admitted that the existing technology is not good enough to serve the customers.

- 90% of the banks would like to invest in omni-channel solutions or modernize their core operating platforms.

On the other hand, Embedded Finance is becoming a game changing opportunity for traditional banks as well as emerging fintech’s wherein they can cater to a new, very large addressable market opportunity completely driven by the concept of banking as a service

ITC Infotech’s Digital Banking Services & Customer

Intelligence Platform

Framework Description

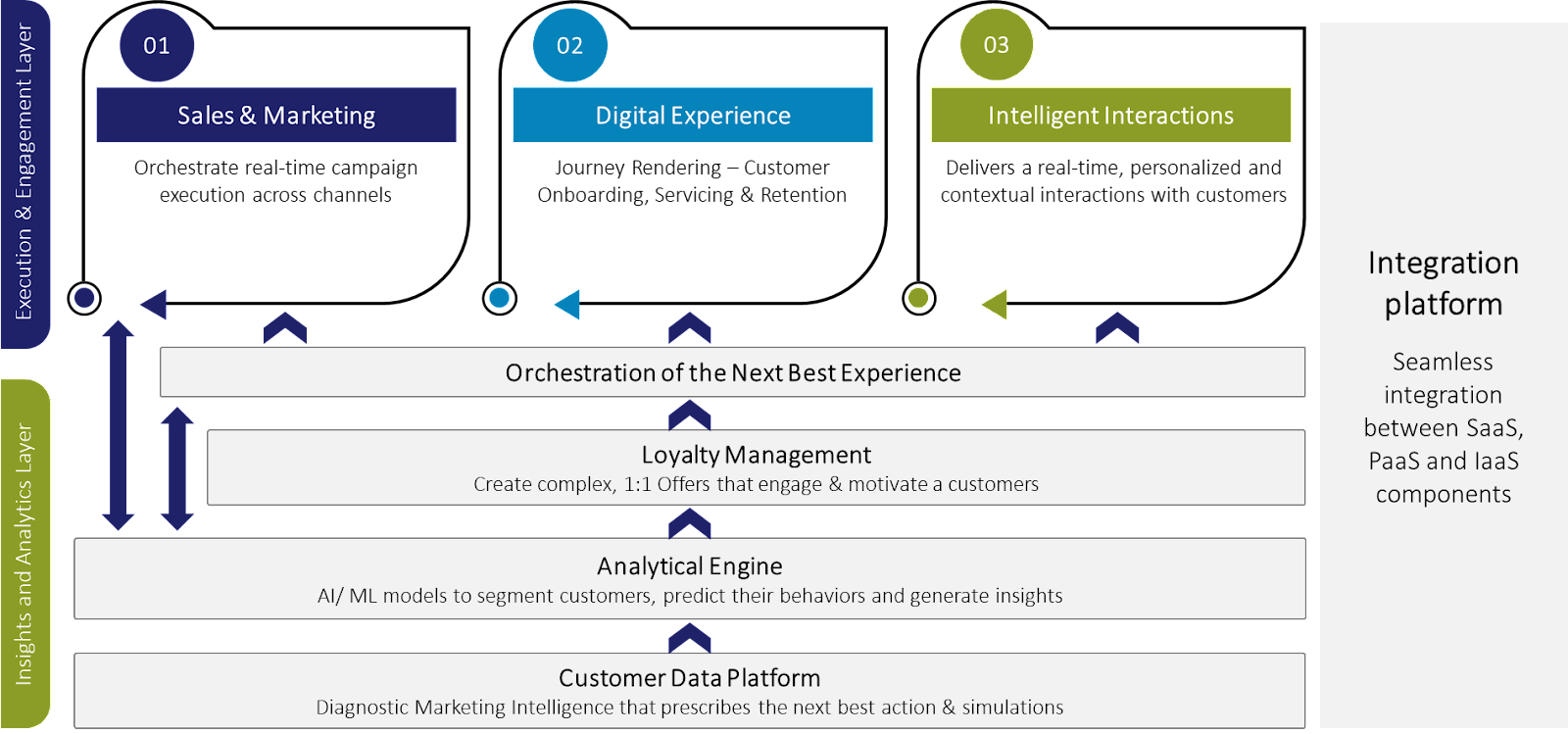

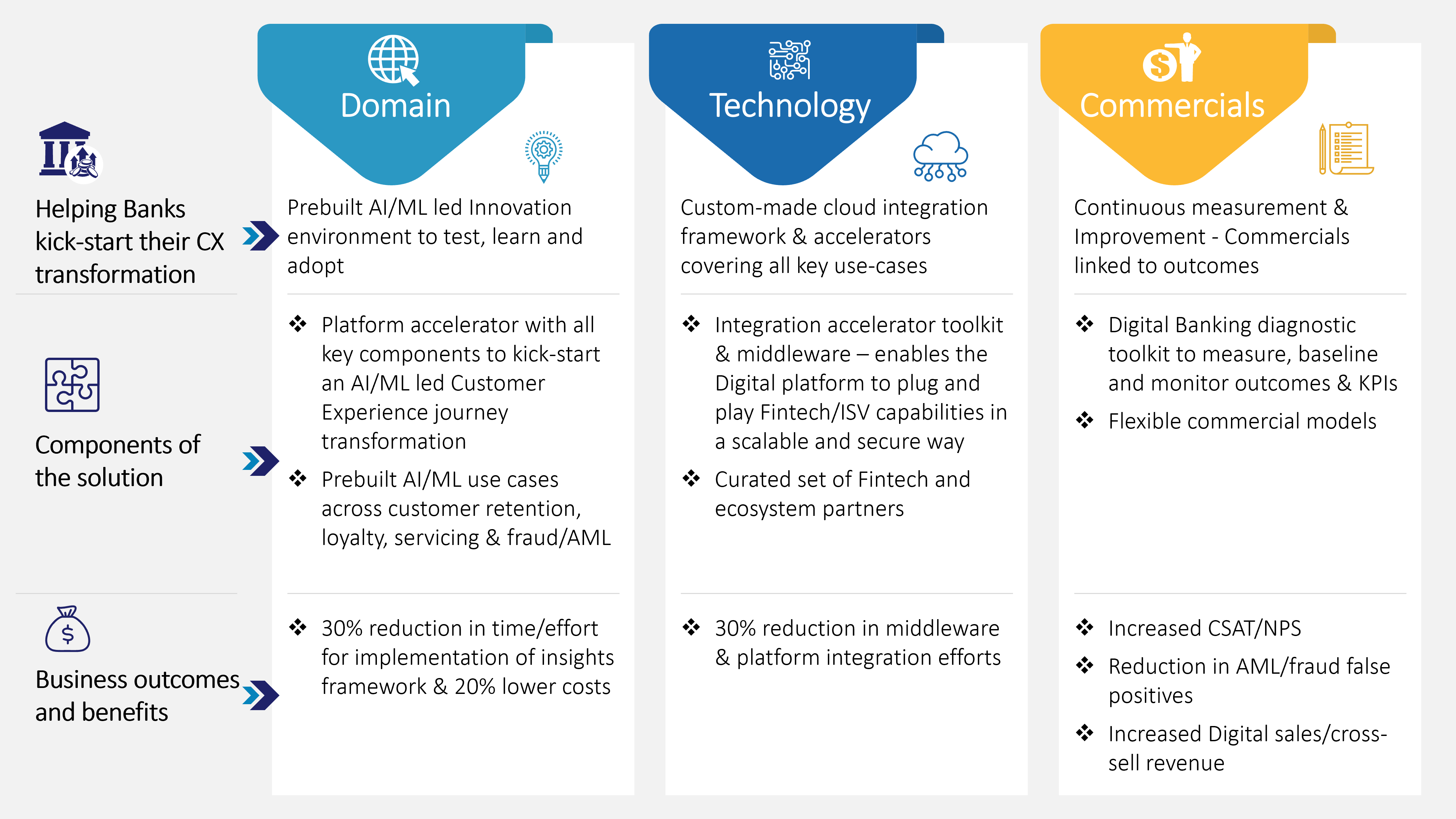

ITC Infotech’s Customer Intelligence Platform solution has been created to help our clients offer as well as consume component banking as a service which in turn will help them improve digital sales. One of the key solution ingredients is to help banks address end-customer needs in real-time with personalized experiences & offers. Our partner-based services span across the experience, automation, and enablement layers. Further our accelerators include prebuilt AI/MI analytical models, fintech integration middleware toolkit, portability tool for all cloud platforms, diagnostic framework to assess enablement gaps and mostly importantly learnings from having offered multiple outcome- based services for our clients that are on their transformation journey

Use Case in Focus

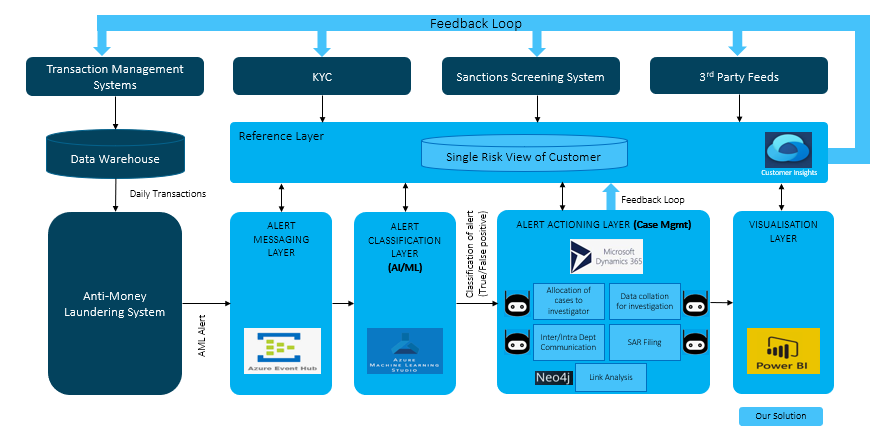

Within the area of financial crime, most transaction monitoring systems (TMS) used by financial institutions look at standard deviations, anomalies, and red-flag topologies. These are mostly rule based that cannot effectively assess a transaction in context of transaction patterns, customer risk score, past alert history, etc. Further these rules are designed to be overly cautious, as to not leave institutions open to a hefty fine should an instance of fraud or money laundering go unnoticed. As a result, more than 90% of the alerts generated by TMS turns out to be false positive.

Our Microsoft based “Contextual Decision-Making Platform” built as a part of our Digital Banking Capability uses Hyper Automation – Artificial Intelligence, Machine Learning, RPA besides a strong data foundation and a Single Risk View of Customer, to

- Identify True and False positive alerts

- Automate processes around

- Case Creation

- Case Assignment

- Data gathering for investigation

- Processing unstructured data

- Managing inter/intra department communication

- Filing of SAR reports

The benefits of the solution are across three key dimensions

Efficiency: By way of reduction in false positive rates, increase in investigation productivity and reduction in operational costs

Effectiveness: Because of reduction in average duration of open cases, increase in case resolution rates, and improvement in SAR disclosure rates

Experience: Reduction in time spent on non-investigative activities and improved ability for redeployment of teams to value added tasks

Trust our Services

For a leading bank in Central Europe, we are currently on a journey to enable them to best leverage their digital traffic and sell more products through a new digital platform. The solution involves implementing microservices-based architecture that helped API enable the bank’s mainframe legacy applications. We have deployed multiple distributed agile product development factories and created an end-to-end test automation framework for them. After going live, this new platform has helped boost traffic by 40%, and there has been a 17% increase in digital sales over 18 months. The bank has been able to onboard 15+ products in 2 years as part of their transformation journey.

On their Corporate & Commercial Banking side of the business, we are helping them build, test & roll out a leading BPM solution across multiple applications focusing on customer lifecycle management, reconciliation, digital lending, treasury and document management covering Austria, Romania & Czech markets

Case Study

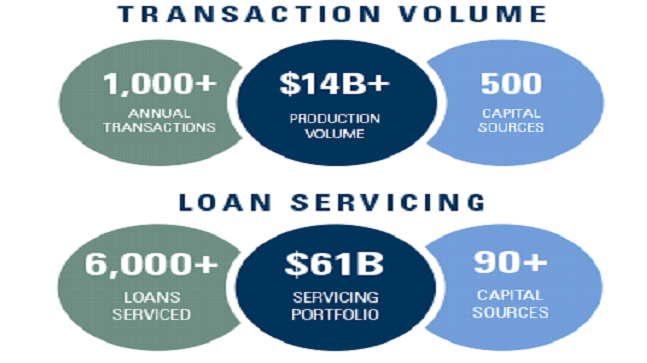

Automation & Innovation Services for a challenger US Commercial Real Estate Broker & Lender

The organization is embarking on a digital transformation journey to reimagine its technology landscape and processes. The transformation is pivoted across three main pillars viz Commercial Excellence, Digitization & Servicing. We are enabling the client’s transformation journey via the automation as well as product strategy tracks

Automation

- Comparison of automation platform across AA, UiPath & Blue Prism, with UiPath being identified as the platform of choice for the execution

- Identification of 3 candidate processes for automation PoC & ~40 processes for future automation as part of process discovery

- Shortlisted processes – financial statement analysis within servicing, extracting & uploading financial documents using upload tool within loan operations

- Successful PoC execution resulting in the demonstrated benefit of FTE reduction in Portfolio Management team and Loan Operations team

Product Strategy

- Product strategy ideation, concept validation, and POC creation

- Voice of the customer – Conducting user research and identification of primary and secondary personas, Conduct secondary research including competitor analysis, Construct as-is and to-be journey maps, Ideate on an MVP using a design thinking led framework, Create wireframes for the initial prototype

- Help define the digital charter for the organization

- Foundation for embarking on an enterprise wise automation journey

- Leverage strengths of the company/ extract value by initiating the product journey

Webinars

Treasury Management, Yesterday - Today – Tomorrow

In a fireside chat with Pedro Porfirio, VP & Global Head of Capital Markets, Finastra, Iain Scott, Global Head of Post Trade, Finastra, and Sunder Ganesh, VP, ITC Infotech discuss the key trends in the Treasury services.

Intelligent Automation SME Lending reimagined during COVID

Sachin Kumar, Head, BFS Consulting, ITC Infotech, and Miguel Traquina, CIO Operations, Santander UK, discuss the major challenges faced by smaller businesses across the globe and how intelligent automation helps reimagine the business.

The Future of Work and Talent - Productivity & User Experience

In a fireside chat on “The Future of Work and Talent – Productivity & User Experience”, Sibusiso Shabangu, CIO and Head of End User Experience, ABSA Group and Sujoy Chatterjee – VP Infrastructure Services, ITC Infotech discuss the long-term strategies CIOs will need to develop for supporting a remote workforce.

Digital-Centric - New Normal for Banking post COVID-19

In this fireside chat, Ranjit Ranadheeran, Global Capability Leader, Banking, ITC Infotech, and Kartik Sivaprakasam, Vice President, i-exceed, discuss the challenges in the banking and the new digital-centric normal in the post-pandemic era.

Why ITC Infotech

“Our BFS propositions over the years have broadly covered areas of data-led customer experience, automation, core system transformation & application support services across our reputed global financial services clients. While we continue to offer a wide range of technology services, our recent focus has been around providing propositions that include insights as a service, intelligent automation leveraging a digital workforce model, and automated application management services; all on the back of our renewed thrust on new-age technologies as well as by leveraging strong product partnerships. We aim to continue delivering business-friendly solutions to our clients while providing them with the flexibility that is critical in today’s environment.”